26/5/ · The lowest price in this chart is If we calculate the difference between these two numbers, we'll see the market declined by or 71 pips. For example, trading a deal in size of 1 lot, 1 pip may cost $ Look at the two scenarios: If you bought at and sold at , you would have lost 71 pips 1. Timeframe of the Forex price chart. A time frame refers to a particular period used to plot price quotes and display the price chart. For example: In a candlestick chart, the timeframe corresponds to one candlestick. If the timeframe is M30, each candlestick displays the range of the price changes every 30 minutes Typically, forex pairs are quoted to four decimal places (). The ‘1’, four spaces after the 0, is what is referred to as a pip. The number ‘7’ in red shows the decimal unit of a pip. If a trader buys GBP/USD for and then later on

How to Read Forex Bar Charts? - Forex Education

Forex charts are your platform where you will be able to make money in Forex. It is essential for your trading performance to understand what you should know and how to read those tools you know. It could be hard to make a dollar in Forex, but it is not impossible. If you know the principle of forex charting, you will have much gained in your trading career. Today we will talk about how to read FX charts and what you should know to trade Forex.

A forex chart is a visual tool to read price movements in a determined period of time. It could be with lines, bars, or ticks, but it will always show where the price of a pair or index is. So, it would help if you had a chart to make better trading decisions in Forex. Before being able to learn the art of reading charts, you should get one. But what is the better chart? Forex charts are everywhere, yet not all the graphs are the same, how to read forex option charts. Reading charts is fundamental for every trader, so each fx broker will provide you with a platform solution that is a trading station with charts and tools.

Thus, the first place to look for an FX chart is your broker. Besides that, other open platforms usually support many forex brokers accounts such as TradingView or the different versions of Metatrader. Finally, you can also access to general economic websites charts offerings to see prices. Note that regular websites have delayed prices. So, the prices you are how to read forex option charts are minute delayed on average. Every platform will present different settings, tools, and visual conditions.

Be sure that those options fit with your trading skills. Almost all charts in the Forex world have the time how to read forex option charts in the bottom of the chart.

Also, prices are shown in the right column next to the table. So you are going to see a cross between bot axis while you are navigating the graph. Usually, prices are posted from the bottom to the top prices the time axis has. Remember, time is at the bottom, prices are at the right band.

It will all depend on the timeframe, but we will talk about that later. When you are watching a chart, you basically see price movements. Well, the main feature here is the price. In a platform, you are going to see a fluctuation of prices where each point moved is called a pip. Pip is essentially the minimal measure of a Forex pair, usually the last of the fourth decimal point. Each movement of the price is a pair, in a chart platform you should identify where the price is, how much it is moving, what is the top rate as well as the minimum valuation.

It will give you a sense of how the pair is performing. Remember that when the pair is going up, it means that the currency in the first part of the ticker is going up, how to read forex option charts, in this case, EUR, and the money in the second part is falling, the USD.

Also, on the contrary. Usually, every broker solution on charts offers different time intervals of time, also called timeframes. As how to read forex option charts short term trader needs as a 1-minute chart, others would prefer a 1-hour or even 1-day timeframes.

The selected timeframe means that every period of a candle, tick or line that the chart shows will represent the selected period of time, or timeframe.

So, brokers offer multiple timeframes to address this necessity. In a chart, the timeframe is easily identifiable. You should only select the code you want to see, and it will magically how to read forex option charts. There is more than one single way to watch charts in the Forex markets. The industry, like any other investment tool, has different forms to print price movements in a map. Samples of charts are the famous wide candlestick, line, bars or point and figure, among others.

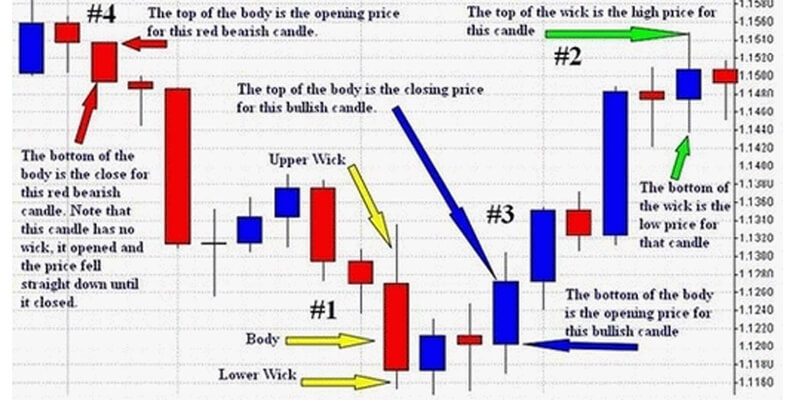

Each different option provides users with specific information that you can use depending on your trading skills. Candlesticks are one of the most popular ways of watch FX charts in the how to read forex option charts. Many traders prefer candles as they are very graphics and show all the needed information at first sight.

It is not hard to understand candlestick charts as they represent movements and reveals four vital information: Opening, closing, how to read forex option charts, maximum, and lowest prices in the period.

It is easy to understand the way the market is moving, up or down, with Candlesticks FX charts. The basic form of visual price movement is Line charts. It represents the continuous performance of a Forex pair across a determined time. It could be set to opening or closing prices, and it is good to be used while identifying the big picture of a pair. OHLC bar charts are similar to candlesticks but not as much as visual as its Japanese relative. Its name stands by Open, High, Low, and Close.

It is a line with two dashes, how to read forex option charts, the dash in the left is the opening price, while the dash in the right represents the closing price.

This type of chart help traders to quickly understand who is in control of the game, the buyers, green lines, or the sellers, the red lines.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Skip to main content Skip to secondary menu Skip to primary sidebar Skip to footer Best Managed Accounts Forex Robots Forex Brokers Forex Signals Social Trading Platforms.

Robots Start Guide Glossary Basics Currency Pairs Charts Candlesticks Trading Tips Strategies Technical Analysis Fundamental Analysis Day Trading Scalping Swing Trading Trend Following News Reviews Forex Robots Forex Brokers Mustreads Crypto Trading.

Table of Contents. Leave a Reply Cancel reply Your email address will not be published. Footer Forex Broker Reviews. Forex Robot Reviews.

How to analyse Forex charts - The ULTIMATE beginners guide

, time: 11:19How to Read Forex Charts (): Easy Examples Explained ��

1. Timeframe of the Forex price chart. A time frame refers to a particular period used to plot price quotes and display the price chart. For example: In a candlestick chart, the timeframe corresponds to one candlestick. If the timeframe is M30, each candlestick displays the range of the price changes every 30 minutes 24/6/ · Our Forex trading PDF, it is widely believed that forex is one of the biggest and most fluid (or liquid) asset markets in the world. Sometimes referred to as FX, currencies are traded 24 hours per day – 7 days per week. The term ‘forex’ is a blend of ‘foreign exchange’ and ‘currency’. In simple terms, refers to the process of 3 Ways to Read Forex Charts - wikiHow

No comments:

Post a Comment